Fed’s Quarter-Point Rate Cut: A Response to a Slowing Job Market

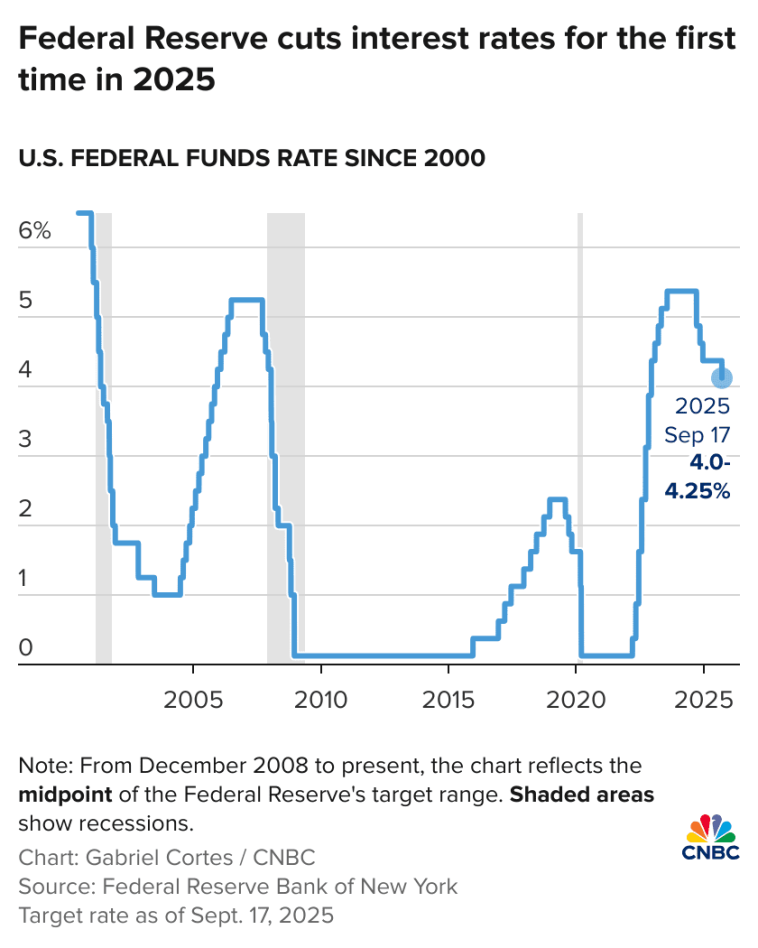

The Federal Reserve is expected to lower its benchmark interest rate by a quarter percentage point in a bid to support a job market that appears to be losing strength. This move marks the central bank’s second rate cut in only six weeks, following a long period of stable rates designed to combat stubborn inflation. Although prices continue to rise at a rate the Fed would prefer to slow, the overriding concern at this point is to prevent a large surge in unemployment.

By choosing to cut rates now, policymakers are hoping to stave off a weakening job market that has seen several major corporations announce sizable job cuts in recent days. For instance, Amazon has vowed to trim its workforce by 14,000 corporate positions, while Target revealed plans to slash about 1,000 corporate roles and leave an additional 800 positions unfilled. Even the federal government is not immune to these trends, with significant layoffs and a forecast that many more federal positions may be eliminated this fall.

Corporate Job Cuts and Economic Readjustment

Impact on Major Corporations in a Shifting Business Climate

Large companies are now confronting the tricky parts of managing growth amid a turbulent economic landscape. With several prominent corporations announcing substantial job cuts, the broader business community is forced to grapple with the tangled issues of balancing corporate profitability against the overhead of maintaining a large workforce.

Some key points to consider include:

- Cost-savings initiatives are top of mind for many companies as they adjust to lower consumer spending.

- The decision to cut jobs is often a mixed bag, offering short-term relief in costs while potentially dampening long-term growth.

- Corporate restructuring in such times highlights some of the confusing bits of modern workforce management and the shifts in consumer behavior.

The efforts made by companies such as Amazon and Target illustrate the fine balance between trimming redundant roles and retaining enough staff to preserve essential functions. Although these layoffs might appear intimidating for affected employees, they are, in many cases, seen as a necessary evil to help the company steer through the twists and turns of an evolving economic reality.

Government Shutdown: Data Limitations and Hidden Complexities

How a Government Shutdown Has Complicated Economic Analysis

The looming government shutdown adds another layer of complexity to an already challenging economic picture. With official data coming in late or missing entirely, both economists and policymakers are forced to figure a path through a landscape filled with tangled issues and missing pieces.

Key factors complicating economic analysis include:

- Delayed reports that leave economists waiting to get into the true state of job gains or losses.

- Uncertainty over whether important job growth statistics for recent months will be recorded at all.

- A reliance on alternative data sources which may only provide a partial view of economic trends.

This situation is particularly nerve-racking for economic policy decision makers. Without timely and detailed government data, understanding the full scope of the current economic state often involves poking around in less conventional sources to catch a glimpse of the hidden complexities behind labor market shifts.

Alternative Indicators: ADP Reports and Consumer Behavior

ADP’s Private-Sector Hiring Numbers and What They Mean

In light of the official government data delays, economists are turning to alternative data sources like the payroll processing firm ADP. ADP recently reported a modest uptick in private-sector hiring over the four weeks ending in mid-October. Although these figures may differ from government tallies, they provide critical clues regarding the broader economic direction.

According to ADP’s chief economist, some very slight improvements in private-sector hiring are noticeable. However, he cautions that these improvements are preliminary and tepid, hinting at the possibility of further softening in the weeks to come. The reliance on such alternative data sources means that businesses must find their way through a landscape left somewhat blurry by missing official data.

Consumer Spending Amid a Slowing Labor Market

While the job market appears to be under added pressure, consumer spending has continued to show resilience. As long as workers have paychecks coming in, they can keep spending, and so far, many consumers have maintained their level of expenditure. Yet, if job growth stalls further or more companies resort to layoffs, this consumer spending might face a significant drag.

Economists point out that the spending endurance seen among consumers is partly fueled by the fact that much of this spending is driven by wealthier citizens. These individuals are less reliant on weekly salaries and can better absorb economic shocks. However, if job losses affect a wider segment of the population, we might see a dip in overall spending which could then adversely affect businesses on numerous levels.

This chapter of the economic story reminds us that our economy is as much about individual behavior as it is about aggregate figures. While macroeconomic indicators such as interest rates and employment statistics provide useful insights, it is essential also to get into the fine shades of consumer habits and spending patterns.

Alternative Perspectives: Expert Opinions and Market Reactions

Insights from Fed Governors and Industry Economists

Fed Governor Chris Waller has been particularly vocal about his focus on the labor market. Commenting on recent events, he noted that payroll gains have weakened so significantly this year that there is a growing risk of actual contraction in employment figures. Such statements underscore the sentiment that the current economic issues are loaded with problems and require prompt remedial measures.

Industry experts, including those from ADP, are keeping a close eye on these developments. Their observations offer a nuanced picture: while there is some improvement in hiring trends, the overall momentum is slow compared to early-year performance. These fine points may seem like small distinctions in the broader economic narrative but are in fact super important for understanding the challenges ahead.

Market Implications of a Rate Cut in a Tense Environment

The decision by the Federal Reserve to cut rates, despite stubborn inflation, highlights the balancing act in place: supporting the job market while not exacerbating price increases. This decision is both a reflection of current economic conditions and a bet on future improvements. Nonetheless, it is also a choice that comes with nerve-wracking uncertainties for market participants.

Here are some of the market implications to bear in mind:

- Investor Sentiment: Lower interest rates might encourage more investment in equities and other growth-oriented assets, even though the job market remains under pressure.

- Consumer Credit: A lower rate environment typically makes borrowing cheaper for consumers, potentially supporting continued consumer spending.

- Business Investment: Companies might be tempted to take on new initiatives or expand operations if financing is more accessible, although they must balance this with caution given the currently shaky job market.

By stepping in with a rate cut at this time, the Fed is essentially trying to man the wheel calmly and steadily, while acknowledging that the current period is full of problems that require careful navigation. It is a move that aims to support a foundational aspect of the economy – employment – even as inflation persists above ideal levels.

Balancing Inflation Concerns and Employment Stability

Why Preventing High Unemployment Takes Precedence Over Inflation Control

One might ask why the Fed is allowing inflation to continue climbing at a concerning pace. The key reason is that preventing a substantial jump in unemployment is viewed as a more immediate priority. Higher unemployment can create a cascade of challenges that ultimately impact every segment of society, from reduced consumer spending to increased reliance on social safety nets.

Some of the key considerations include:

- While inflation is indeed a ticking time bomb, its immediate effects tend to be more gradual. In contrast, sudden and widespread job losses can lead to rapid economic decline.

- The cost of unemployment is measured not only in economic output but also in social and human terms. Families facing job loss may reduce their spending dramatically, which in turn affects local businesses and broader economic confidence.

- The Fed’s decision reflects a belief that stabilizing employment may eventually help control inflation, as a more robust job market would support consistent consumer spending and investment.

In effect, the Fed is choosing to focus on the workforce as a key indicator of economic health. By addressing the immediate threat of a weakening labor market, the central bank hopes to create a buffer against long-term economic downturns. This approach is not without risks, but many experts believe that ensuring jobs come first is the best way to support a broader and more sustainable recovery.

Economic Data Delays: How Businesses Are Coping

Strategies for Adapting to Choppy and Incomplete Economic Reports

The current government shutdown has introduced a level of uncertainty in the economic landscape that is both confusing and nerve-racking. With important job statistics delayed or entirely absent, companies and investors are forced to look for alternative indicators to stay on top of market conditions.

Some strategies being employed include:

- Diversifying Data Sources: Businesses are increasingly relying on private sector reports, such as ADP’s hiring data, to gauge the current state of employment.

- Gathering Anecdotal Evidence: Many companies are using firsthand reports from business contacts and industry networks to piece together the actual state of the job market.

- Monitoring Consumer Sentiment: Companies are also watching trends in consumer spending as a proxy indicator of economic confidence and resilience.

While these methods are by no means as comprehensive as official government data, they help businesses figure a path through the maze of current economic information. In many respects, businesses must now learn to take a closer look at every available detail—even those that might seem trivial—so that they can steer through the coming months with a bit more confidence.

Consumer Spending in a Time of Economic Uncertainty

How Shifts in Employment Impact Daily Spending and Retail Sectors

Consumer spending is perhaps the most visible sign of how economic decisions made at the policy level translate into everyday impacts. With the current economic climate marked by job losses and layoffs in key sectors, many observers are trying to figure a path through the likely repercussions on consumer behavior.

Key observations include:

- Consumers with steady employment are continuing to spend, even if cautiously.

- Retail sectors, particularly those that cater to essential needs, remain relatively stable, though discretionary spending in non-essential segments could face challenges if the job market weakens further.

- There is a growing concern that if the labor market deteriorates significantly, then even the reliable spending habits of traditionally robust sectors could turn off-putting.

Ultimately, the interplay between job stability and consumer spending creates a feedback loop that can either bolster economic recovery or lead to a deeper downturn. Shifts in employment, especially unexpected ones, could trigger a more cautious approach to spending, thereby amplifying the broader economic slowdown.

Lessons from the Past: Comparing Modern Challenges to Historical Trends

Reflecting on Previous Economic Cycles to Inform Future Decisions

History offers several lessons on the twists and turns of economic policy, particularly when it comes to managing conflicting pressures such as inflation and unemployment. In previous downturns, central banks have had to make nerve-racking decisions that balanced short-term economic pain with long-term benefits. Today’s situation is not all that different, though the tools and context have evolved significantly.

Looking back, we can identify several enduring themes that help clarify today’s decisions:

- Balancing Priorities: Past rate cuts have often been implemented when employment figures started to decline sharply, even if inflation had not yet come under full control.

- The Role of Consumer Confidence: Historical data suggests that even modest increases in unemployment can have outsized impacts on consumer behavior, leading to a self-reinforcing cycle of economic slowdown.

- Alternative Economic Indicators: Before the advent of high-frequency data from private sources, policymakers often had to rely on indirect measures of economic activity to make timely decisions.

These historical insights are super important for guiding both policy choices and business strategies. Today’s central bank actions, while tailored to the modern economy, are ultimately rooted in lessons learned during previous economic cycles—lessons about how to manage the hidden complexities of economic recovery.

Looking Ahead: The Future of the Labor Market and Interest Rates

Forecasts and Expectations in an Uncertain Economic Environment

As the Fed prepares to initiate another rate cut, all eyes remain fixed on how the labor market and consumer spending will respond in the coming months. The decision reflects a broader expectation that, while inflation remains a tricky part of the equation, preventing a spike in unemployment is essential for maintaining overall economic stability.

What might we expect moving forward?

- Gradual Policy Adjustments: Economists predict that further adjustments in monetary policy could be on the horizon if the labor market does not show signs of significant improvement.

- Monitoring of Alternative Indicators: With official data in short supply, greater emphasis will likely be placed on private sector reports and anecdotal evidence to guide decision-making.

- Reaction of the Business Community: Companies may continue to exercise caution by limiting hiring and even pursuing additional rounds of job cuts if economic signals grow increasingly negative.

This projection is, however, not without its risks. A slowdown in job growth could lead to a cyclical decline in consumer spending, which in turn might necessitate even more aggressive monetary easing. The path ahead is undoubtedly filled with tangled issues and some confusing bits that both policymakers and business leaders will need to address with care.

Strategies for Small Businesses and Local Economies

How Small Enterprises Can Adapt to a Variable Economic Landscape

The current economic environment, as dictated by uncertain job statistics and varying consumer spending, poses particular challenges for small businesses and local economies. Without the deep pockets of large corporations, small enterprises must be exceptionally resourceful to remain competitive and solvent during these times.

Some strategies that small business owners might consider include:

- Diversifying Revenue Streams: By offering a broader range of products and services, small businesses can cushion losses in areas most affected by economic slowdowns.

- Flexible Staffing Solutions: Embracing part-time or contract labor can help manage labor costs while preserving the ability to adjust quickly to market changes.

- Enhanced Digital Presence: Investing in online marketing and digital sales channels can open up additional revenue streams and help internationalize local offerings.

- Community Engagement: Building strong relationships within local communities can foster customer loyalty, even during periods of economic strain.

By figuring a path through these choppy times with careful financial planning and adaptive business strategies, small businesses can not only weather the storm but also position themselves to thrive once market conditions improve. These steps, although they may seem simple, are key to managing the hidden complexities inherent in today’s economic environment.

Industry Manufacturing, Automotive, and Electric Vehicles: Sectoral Impacts

How Uniform Economic Trends Are Affecting Diverse Industries

While the current focus has largely been on employment and consumer spending in traditional sectors, other fields such as industrial manufacturing, automotive, and electric vehicles are also experiencing their own twists and turns amid this turbulent economic period.

In the industrial manufacturing sector, the slow pace of job growth could lead to reduced production capacity and delayed investments in new technologies. For the automotive industry, erratic consumer spending and cautious borrowing may result in lower sales and deferred production plans. Meanwhile, the electric vehicle market, which has been booming in recent years, might see a slowdown if the ripple effects from broader economic uncertainties reduce consumer enthusiasm for premium-priced technology.

However, it is important to note that these sectors have shown resilience in the past. Innovation and shifting market dynamics help create opportunities even in tense times. Businesses in these sectors are strategizing by:

- Incorporating automation and streamlining production processes in industrial manufacturing.

- Developing flexible finance plans and diversifying product lines in the automotive world.

- Enhancing battery technology and reducing costs to keep electric vehicles within reach of a broader market.

Even as industries face their own sets of challenging and off-putting decisions, the key remains to leverage technological advancements and innovative business models to sustain growth. By finding creative solutions to manage their internal expenses, these sectors are learning to work through both the obvious and the confusing bits of the current economic landscape.

The Role of Business Tax Laws in Shaping Future Investment

How Tax Policy Adjustments Can Influence Corporate Behavior

Business tax laws are another critical piece of the puzzle that companies must consider when planning their strategies for the future. Adjustments in tax policy can either incentivize or deter investments, hiring, and expansion. During economic downturns, businesses may be hesitant to commit to significant capital expenditures, and any changes in tax laws can have a direct, tangible impact on bottom lines.

Key points include:

- Tax incentives for research and development, which are especially important in industries like automotive and electric vehicles, can spur innovation and long-term growth.

- Temporary tax breaks or deferrals offered during periods of economic uncertainty may help businesses manage cash flow and reduce the nerve-racking burden of operating in a volatile market.

- Conversely, increases in corporate tax rates or changes to depreciation rules might lead to delayed projects and a more cautious approach to hiring.

The interplay between monetary policy, job market conditions, and business tax codes is loaded with issues that require careful thought. By taking a closer look at the little details of tax law changes, companies can refine their strategies to maintain healthy investment pipelines even in a challenging economic setting.

Conclusion: Finding a Path Amid Twists, Turns, and Uncertainty

The Federal Reserve’s decision to cut interest rates by a quarter point is more than a routine adjustment—it is a clear signal that policymakers are deeply concerned about a weakening labor market and its potential ripple effects across the economy. With corporate giants announcing layoffs, a government shutdown limiting access to crucial economic data, and mixed signals from alternative indicators like ADP, the current economic landscape is full of problems that require careful, considered responses.

For businesses, consumers, and policymakers alike, the current period is one where every decision must account for the fine points of both immediate survival and long-term stability. Whether you are a small business owner, a corporate executive, or simply an engaged citizen, it is essential to dive in, review these developments critically, and understand that while the road ahead is filled with tangle and confusing bits, there are still opportunities to steer through and eventually come out stronger on the other side.

The multilayered issues in today’s economy—from fluctuating employment numbers to cautious consumer spending—demand strategies that are both adaptive and forward-thinking. With interest rates reduced in a bid to encourage spending and hiring, businesses now have a window to recalibrate strategies and focus on areas that can drive growth despite immediate setbacks. While significant uncertainties remain, especially with incomplete official data due to government shutdowns, the resilience of key economic players and sectors offers a glimmer of hope.

Ultimately, as we navigate through these challenging times, the commitment to finding innovative solutions and relying on a mix of traditional and alternative economic indicators will be super important. The Fed’s measured rate cut is not an end but rather the beginning of a new phase of decision-making—one that emphasizes the critical need to support the labor market while managing inflation pressures. Every business, from major corporations in industrial manufacturing to local small enterprises, stands to benefit from a policy environment that puts jobs and spending at the forefront.

By remaining flexible, paying attention to the subtle differences in economic trends, and staying engaged with emerging data points, all of us—be it policymakers, business leaders, or everyday consumers—can work through the tricky parts of this vast economic challenge. The focus now is to learn, adapt, and prepare for the next phase of our economic journey, ensuring that we keep the workforce robust and the consumer spending active despite an environment that is occasionally off-putting and uncertain.

As we look to the future, many questions remain. Will further reductions in policy rates become necessary? How quickly can we expect official data to catch up with the alternative indicators? And will the crossfire between corporate cutbacks and consumer resilience create long-term shifts in economic behavior? The answers to these questions will be unfolding in the coming months, and effective decision-making will hinge on the ability to make sense of even the smallest twists and turns in the economic narratives.

For now, we stand at a crossroads where the choices made today could shape the economic stability of tomorrow. Whether you are a local business owner, a corporate strategist, or simply a keen observer of economic trends, remember that every policy move and every market reaction is an opportunity to work through the tangled issues and find a solid foundation for future growth. The journey ahead may be complicated and full of hidden problems, but with careful analysis and timely action, the potential for a brighter economic future remains well within reach.

In summary, the Federal Reserve’s proactive stance on cutting interest rates underscores a broader commitment to safeguarding employment and nurturing consumer spending. Despite the nerve-racking uncertainties of a stalled government data pipeline and unpredictable market responses, a measured approach that marries policy shifts with attention to alternative indicators appears to be the prudent path forward. For every stakeholder in the economy, it is now time to dig into these economic trends and prepare for both the immediate challenges and long-term adjustments that lie ahead.

Ultimately, the evolving narrative of our economy is not one of inevitable decline but of the remarkable resilience of business and innovation. By staying informed, flexible, and engaged with every nuance and subtle detail, we can all help steer our economic future in a positive direction. The road ahead is filled with both daunting challenges and promising opportunities, making it essential for every segment of society to join in the effort to stabilize and eventually revitalize our economic landscape.

Originally Post From https://www.kgou.org/business-and-economy/2025-10-29/fed-expected-to-cut-interest-rates-as-job-market-shows-signs-of-weakness

Read more about this topic at

Navigating the current economic crisis: A guide to surviving …

Good Jobs Challenge